Back to the Future: Trump, Tariffs and Trade Wars

Do you remember the Back to the Future trilogy? In the second part, the antagonist Biff Tannen finds a sports bulletin with the results of all major sporting events for the next several decades. He travels back in time, gives the newsletter to himself and begins making perfectly timed bets making a huge fortune. The result? When protagonist Marty McFly returns to the present, the world has changed completely – dark, chaotic, and subject to Biff’s greed and manipulation.

The newly elected American president, Donald Trump, has brought tariffs back into the public discourse, and will probably bring them back into play, firstly towards China, Canada and Mexico.

A seemingly simple decision – like raising trade tariffs – can have huge repercussions across the global economy: it can affect jobs, prices and even entire industries, in ways we often cannot fully predict.

Reading about this topic, a question is running through my head – If we “meddle” with trade policies again, what kind of economic reality will we wake up to? Will it be anything like the dystopia that Marty McFly experienced?

Trade tariffs 101

Imagine that you are driving from Skopje to Thessaloniki. To save time, you take the highway—but at every toll booth, you have to pay a fee. You get there faster, but at a higher cost. Tariffs work in a similar way. Think of them as “tolls” for goods and services. For example, if you’re a manufacturer exporting products to the U.S., the tariff is the customs duty you have to pay to get your goods into the country.

Here’s how it works:

- Suppose your product costs $100. If the tariff is 10%, buyers in the U.S. now pay $110.

- The higher price makes your product less attractive compared to alternatives, assuming all else remains equal (ceteris paribus).

Just as high tolls can discourage drivers from taking the highway, tariffs discourage international trade. Buyers may turn to cheaper options, and businesses facing higher costs might cut wages or jobs to stay afloat. Even if your business doesn’t trade directly with the U.S., the ripple effects of such policies can spread across the economy.

Trump’s Trade Wars: The Sequel

During his first term, Trump imposed sweeping tariffs on China, disrupting global supply chains. Imports to the U.S. in affected sectors dropped by 25–30%. Companies spent billions reorganizing their production, and American consumers bore the brunt of higher prices—$3 billion extra per month in taxes alone.

Now, as Trump eyes a return to the presidency, he’s ramping up the rhetoric. This time, he’s looking beyond China, taking aim at Europe, particularly its auto industry. At a recent rally, he declared:

“They don’t buy our cars or our agricultural products—they don’t take anything!”

To give you some context, in 2023, Europe exported $42.5 billion worth of vehicles to the U.S., while importing just $7.8 billion worth of American cars—a trade imbalance Trump views as unfair. But if he imposes new tariffs on European cars, the consequences won’t be confined to Germany or France.

Okay, but how are these things related to North Macedonia?

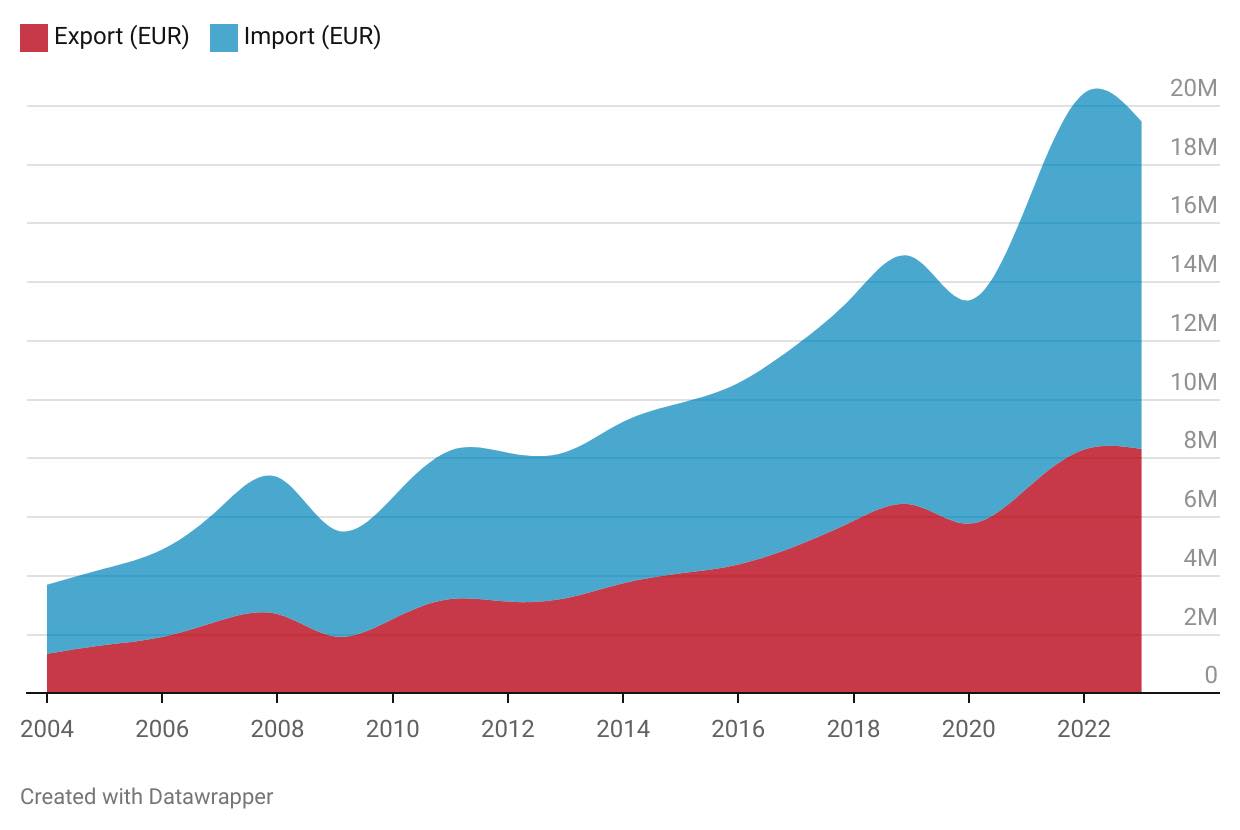

Well, North Macedonia is a small, open economy. That means we rely heavily on trade, exporting and importing goods around the world (Figure 1). Our key trading partners in the automotive sector are Germany (18%), Belgium (25%), and Hungary (20%) and whenever something happens with them – be it a political decision or a price policy – it can directly affect us.

Figure 1. Total Import and Export 2004-2023

Source: State Statistics Office, 2024

Let’s say Germany produces fewer cars because of a 10% tariff Trump imposes. Demand for Macedonian-made car parts would plummet. This could lead to reduced factory output, lower wages, or even layoffs in our local economy.

In short, decisions made thousands of miles away in Washington can ripple through global trade networks and hit home

The Automotive industry in North Macedonia

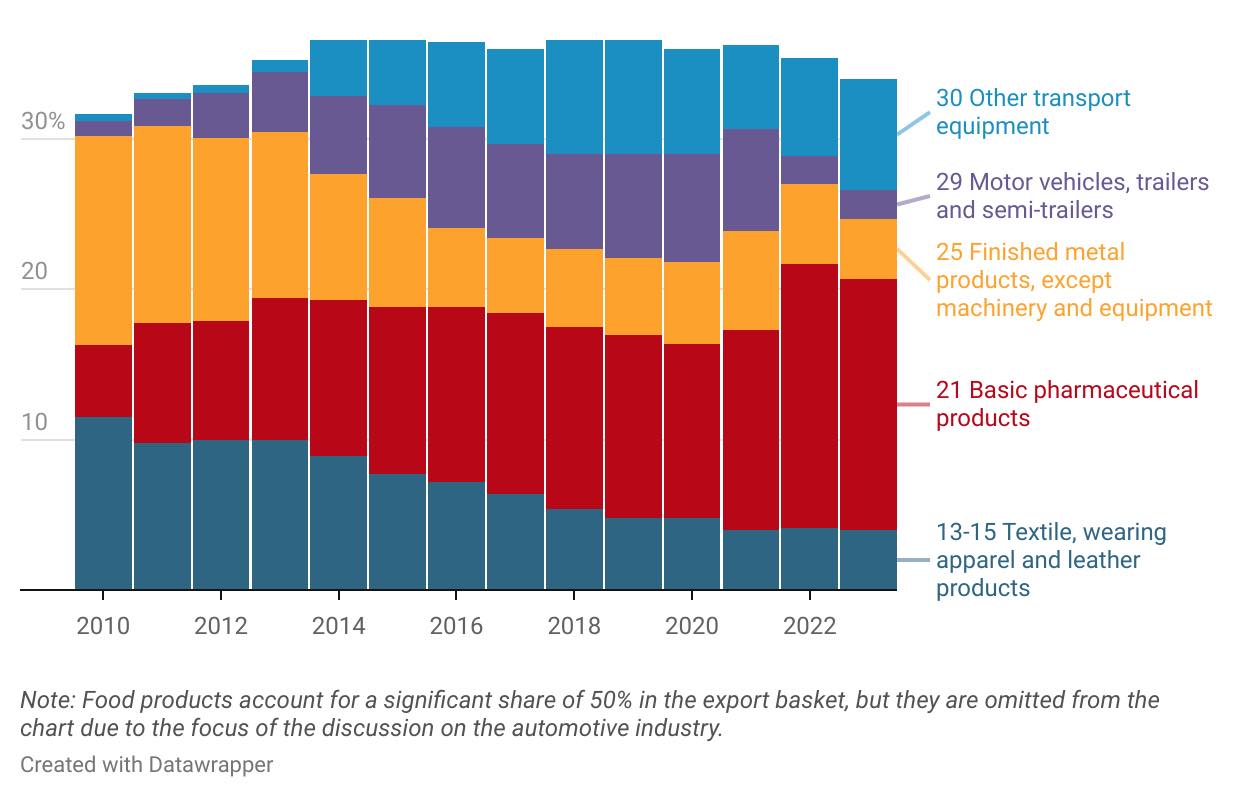

Over the last decade, North Macedonia’s export profile has changed (Figure 2). You’ll notice that the light blue and purple components have been increasing over the years since the early 2010s, while textiles have been declining. This is the result of the influx of foreign direct investments in the Technological Industrial Development Zones, new market trends and technological changes.

In 2023 alone, North Macedonia exported €8.3 billion worth of goods, with 14% coming from the automotive sector. Our factories supply key components to major European car manufacturers. If tariffs hurt Europe’s economy, our factories will feel the impact almost immediately.

Graph 2. Export basket

Source: State Statistics Office, 2024

What exactly does this mean for the export of the automotive industry from the country?

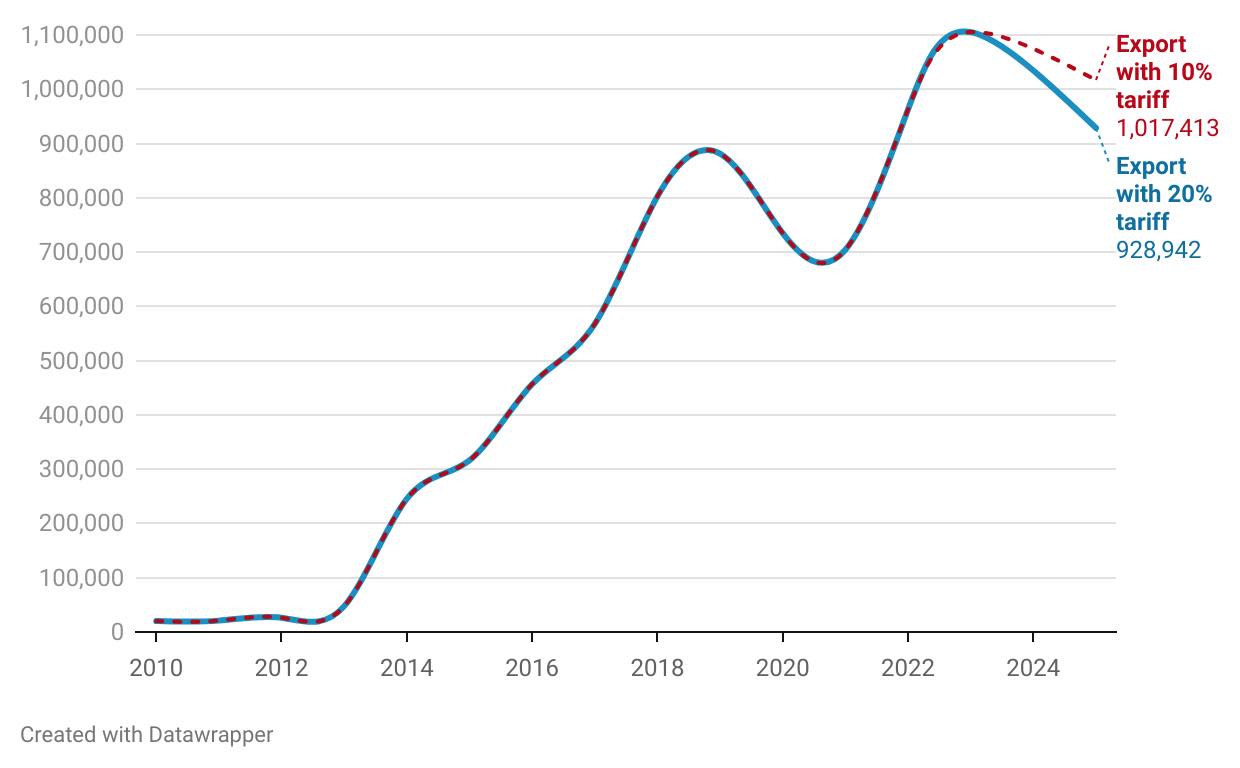

Below I simulate two scenarios for you, based on what Trump announced:

- Increase on customs duties for 10% of European car exports

If the way in which the volume of exports reacts to the increase in the price of the export product (price elasticity) is -0.8, and exports for 2023 are 1,105,884 thousand euros, an increase in customs duties by 10% would mean that exports would fall by 8 %.

New exports: 1.02 billion euros.

- A 20% increase in tariffs on European car exports

With the same price elasticity of -0.8, if tariffs increase by 20%, exports will fall by 16%.

The new export: 928.9 million euros.

So with 10% higher tariffs, exports will be back to where they were in 2022, and if they rise to 20%, exports may fall to where they were in 2021. In both scenarios, Macedonian exports take a hit. The reduced demand from the European markets may lead to a slight slowdown of the automotive sector in the country.

Chart 3. Scenario analysis, change in the export of the automotive industry based on the tariff model

Source: Author’s calculation

Note: Note: In this calculation, I assume that the tariffs would spill over to the target markets and subsequently impact our production, which is why I use the values for 10% and 20%. The price elasticity coefficient, reflecting how demand changes in response to price increases, is applied based on recommendations from the available literature (Kee et al., 2008 And Ghodsi et al., 2016).

The data refer to the export of motor vehicles according to the code “29 Motor vehicles, trailers and semi-trailers” from the Classification of Products by Activities (KPD).

Why is all this important?

Although trade wars may seem abstract, they can have real and tangible consequences. For a small economy with steadily growing auto exports, shifts in global politics can directly impact jobs, incomes, and economic growth.

Unfortunately, we don’t have a magical DeLorean like Marty McFly to travel back in time and fix things. That’s why staying informed and preparing for the future is crucial.

_____________________________________________________________________________

Data visualization for this post

I’ve put together an interesting data visualization for this release

_____________________________________________________________________________

What have I been reading lately?

Here are some interesting articles I read recently:

- The invisible but everyday challenges of inactive women in the labor market

- The impact of work-from-home policies on the housing market

- Government measures to limit prices

_____________________________________________________________________________

Methodology

Suggested methodology: Rrandomized controlled trials (RCTs)

_____________________________________________________________________________

This is post number 001. Any questions or suggestions related to calculations or the content of this blog can be submitted to theecondigest@gmail.com.

Author: Stefan Tanevski

The Econ Digest