Imagine you are at your favorite café, ordering an espresso. Last year, it cost 70 denars. Today, the waiter charges you 110 denars. You are a bit surprised, but still pay. It seems like everything has become more expensive. A few months later, the price jumps to 120 denars, then 130. By now, you no longer hesitate—you simply expect prices to continue rising.

This is the hidden effect of inflationary expectations. When businesses and consumers begin to believe that prices will keep rising, they adjust—wages increase, prices go up, or people start buying more quickly than usual (to stock up at lower prices). But how much of these price increases are due to actual increase of costs, and how much stems from inflationary expectations? In the case of coffee, it is true that coffee prices on global markets have risen. While roasters and coffee producers sometimes purchase at these market prices, they often have long-term contracts with farmers at pre-agreed prices. This makes it harder to determine to what extent the increased price of an espresso is directly caused by higher costs or driven by expectations of continued inflation.

In the Short Run Prices are ‘Sticky’

Due to the so called ‘menu costs’, restaurants do not always adjust their prices immediately when input costs rise, leading to short-term price rigidity. However, if such cost increases persist or inflation remains high, restaurants are forced to update their menu prices. In times of high inflation, price hikes become more frequent. Inflationary expectations also play a crucial role—if companies expect further price increases, they may proactively incorporate these expectations into their final prices.

Consider the Last Few Years

This phenomenon was particularly evident in recent years when high prices were driven by supply chain disruptions—initially due to distribution problems related to the Pandemic and later as a result of the Food and Energy Price Crisis. While inflation was largely triggered by external factors, the impact of domestic factors on price growth cannot be entirely dismissed.

Isabel Schnabel, a member of the Executive Board of the European Central Bank, highlighted in her August 2023 speech:

“[T]here is often an asymmetry between positive and negative cost-push shocks. While firms are quick to pass large cost increases onto consumers, they may be more reluctant to pass on declines in marginal costs.” (Kharroubi et al., 2023)

To examine the influence of international and domestic factors on food inflation, in this policy brief, we assessed the transmission rate of global price increases to domestic prices of food.

Food Price Transmission Analysis

Using the methodology by Abdallah et al. (2020), we calculated the extent to which international food prices have been transmitted to the domestic economy, specifically to producer and consumer food prices.

A value greater than 1 indicates full transmission, meaning that changes in international prices are fully reflected in domestic prices. A value less than 1 suggests partial transmission, while a negative value implies that falling global prices are accompanied by rising domestic prices, and vice versa. To analyze the findings, we took the median transmission rate of food price changes.

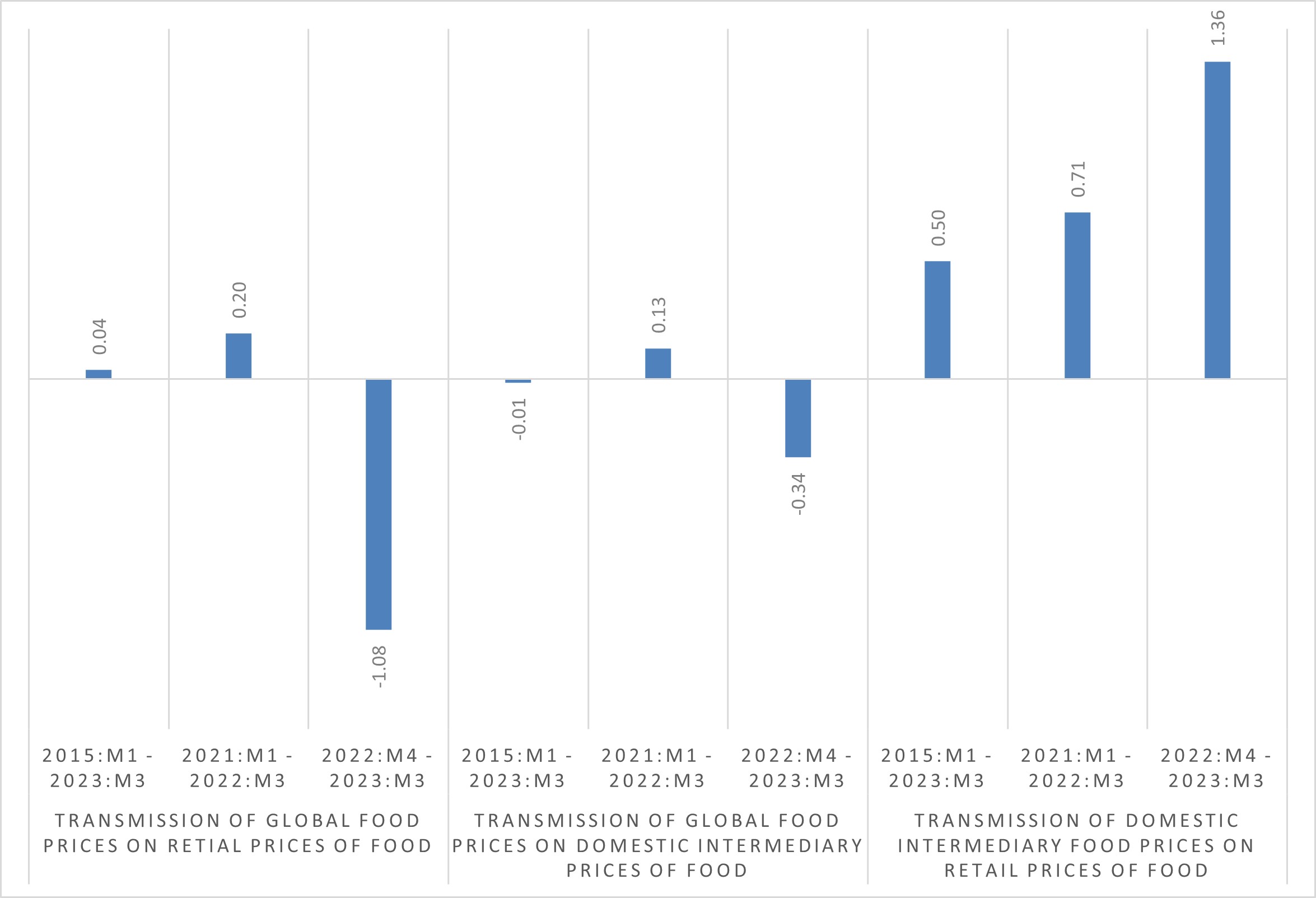

The results in Figure 1 show that between January 2021 and March 2022, the increase in global and producer prices was transmitted to retail food prices, with the transmission from intermediate to retail prices being significantly higher (0.71) than from international to intermediate prices (0.13). This suggests that producers and retailers played a key role in transmitting the price shock.

Although global prices declined between April 2022 and March 2023, retail food prices continued to rise. The drop in global prices had a limited effect on intermediate prices (-0.34), while final prices kept increasing (+1.36), indicating some resistance to price reductions.

Figure 1 – Median Transmission Rate of International Prices to Domestic Intermediate and Retail Food and Beverage Prices (Month-to-Month)

Source: Author’s calculations

Price Pressure Transmission in the Green Markets

Using a similar approach, in another policy brief analyzed the transmission rate of wholesale price pressures to retail fruit and vegetable prices in green markets using the following formula:

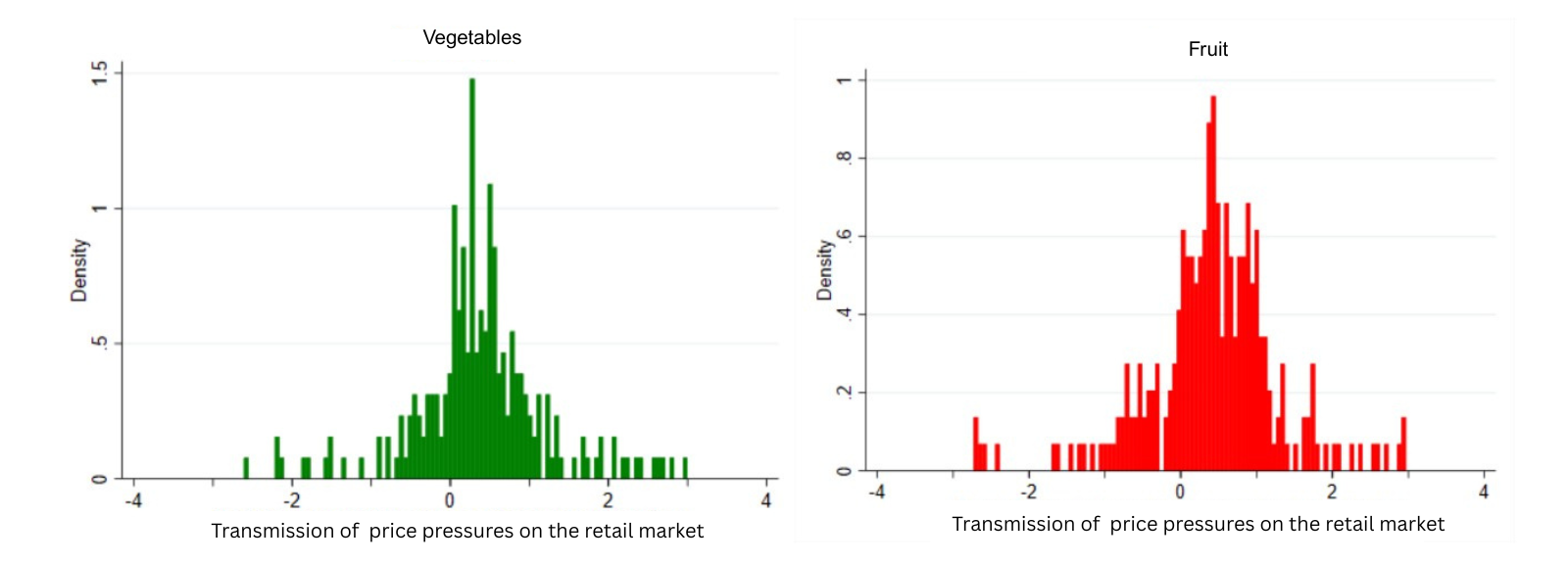

Histograms in Figure 2 reveal that most transmission rates are below 1, indicating that while wholesale price pressures on fruits and vegetables are passed on to consumers, they are not fully transmitted. This suggests that green market prices are not a significant source of additional inflationary pressure. However, in 19% of vegetables and 21% of fruits, the transmission rate exceeds 1, indicating that in certain cases, retailers amplify wholesale price pressures.

Figure 2 – Transmission Rate of Wholesale to Retail Prices in the Green Markets Source: Finance Think calculations

The Role of Inflationary Expectations

High input prices during the consecutive crises were passed on to final goods and services, driving up core inflation, which excludes food and energy from cost-of-living calculations.

Core inflation is a key indicator of the extent to which inflationary expectations are anchored in companies and households. Just as intermediate prices affect retail product prices, inflationary expectations can influence the inflation rate itself. Returning to the “menu cost” example mentioned earlier, if restaurants anticipate further price increases, they may factor these expectations into their newly printed menus.

Figure 3 shows that core inflation peaked in the first quarter of 2023 before slowing to 4.8% in the second quarter of 2024. However, in the last two quarters of 2024, inflation accelerated again to 5.5% and 5.6%, respectively. According to the National Bank (2025), this may be due to rising tobacco prices following higher excise taxes and increased restaurant and hospitality service prices.

Figure 3 – Core Inflation (Annual Growth, %)

Inflationary expectations play a crucial role in determining future inflation. The National Bank measures these expectations through a survey of economic analysts, in line with the practices of the European Central Bank.

Besides expectations for future inflation, past inflation experiences can significantly influence future inflation trends (IMF, 2023). In developing countries, past inflation experiences shape inflation expectations, making the policy interest rate less responsive, thus slowing down inflation reduction. This may also be the case in former Yugoslav republics, which faced high inflation in the 1990s. Considering this, central banks should focus on managing future expectations through enhanced communication, ensuring that inflationary expectations are anchored in the monetary policy signalization.

Data visualization for this post

EU-US trade: how tariffs could impact Europe

What have I been reading lately?

Here are some interesting articles I read recently:

High markups reduce pass-through of cost-push shocks, but only when the shocks are disinflationary

How Managing Inflation Expectations Can Help Economies Achieve a Softer Landing

Methodology

Suggested methodology: Field Policy Diagnostics

This is post number 003. Any questions or suggestions related to calculations or the content of this blog can be submitted to theecondigest@gmail.com.

Author: Marija Basheska

The Econ Digest